Employee benefit plan audit

Our team of experienced professionals advises employee benefit plan sponsors across many areas, spanning audit support, strengthening internal controls, improving efficiencies, helping to ensure adherence to plan provisions and ERISA guidelines, and more.

BPM’s Employee Benefit Plan Audit: Differentiated experience

BPM Partner and employee benefit plan industry group Co-Leader Ryan Davis explains how BPM’s experience in this area is increasingly specialized and sought after.

Latest insights

Navigating the world of employee benefit plan audits is no easy task. Thankfully, BPM has a team of accomplished professionals focused on bringing you the most relevant news and guidance to help inform your journey.

- IRS clarifies meaning of plan “contribution” for tax deduction purposes

- Now is the time for MEPs

- Including financial wellness in your retirement plan strategy

- SECURE Act 101 – New law changes plan policies

- Stopping cybertheft of plan assets before it happens

- Which documents must you surrender if you’re sued?

- Demystifying plan audits: Proactive risk management can ease the process

- Is it time for a collective investment trust

- Reap the rewards of managed fund fees

- CARES Act expands financial options

- How to handle laid off employees’ 401(K) accounts still in your plan

- CARES Act balancing act

- Don’t let employee tip income trip you up

- Coming soon: Pooled employer plans

- Are you ready to track part-timers’ hours?

- What you need to know about SECURE Act 2.0

- Five common 401(k) compliance issues and how to avoid them (bpm.com)

- Form 5500 participant counting change impacting audit requirements

- 401(k) audit requirements: Everything you need to know

Employee Retirement Income Security Act of 1974 (ERISA)

With the passage of ERISA, plan sponsors are held responsible for ensuring the accuracy of their plans’ financial statements. Employee benefit plan audits offer comfort that a plan’s financial statements have been subject to an annual independent examination, and that the plan’s processes and financial controls supporting the financial statements have been reviewed in conjunction with the independent audit. Audits of employee benefits plans are unlike other audits; they are subject to very specific laws and regulations that require specialized knowledge to execute. The type of plans we audit include:

- Defined contribution

- Defined benefit

- Employee stock ownership

- Health and welfare

- 403(b)

Our team

BPM’s employee benefit plan audit team consists of dedicated professionals with extensive knowledge of ERISA guidelines and deep expertise performing employee benefit plan audits. We work with plan sponsors and other fiduciaries to ensure their plans are compliant with ERISA reporting requirements, the Department of Labor requirements, IRS requirements and other regulations.

We communicate directly with the plan’s third-party service providers, minimizing time spent away from the core business. Every effort is made to reassign our staff to the same jobs each year to preserve relationships, establish continuity and provide a seamless audit experience. As our clients will attest, our streamlined and focused audit approach translates into time and cost savings for the plan sponsor.

AICPA Employee Benefit Plan Audit Quality Center Member

As a member of the American Institute of CPAs Employee Benefit Plan Audit Quality Center, we are committed to adhering to the highest quality standards by voluntarily agreeing to the Center’s membership requirements, which include:

- Designating a partner responsible for our employee benefit plan audit practice

- Establishing quality control programs

- Performing annual internal inspection procedures

- Making our peer review report findings public

- Meeting extensive training and education requirements

At BPM, our goal is to continue to enhance our quality initiatives within our employee benefit plan audit practice to deliver the highest quality audit services possible.

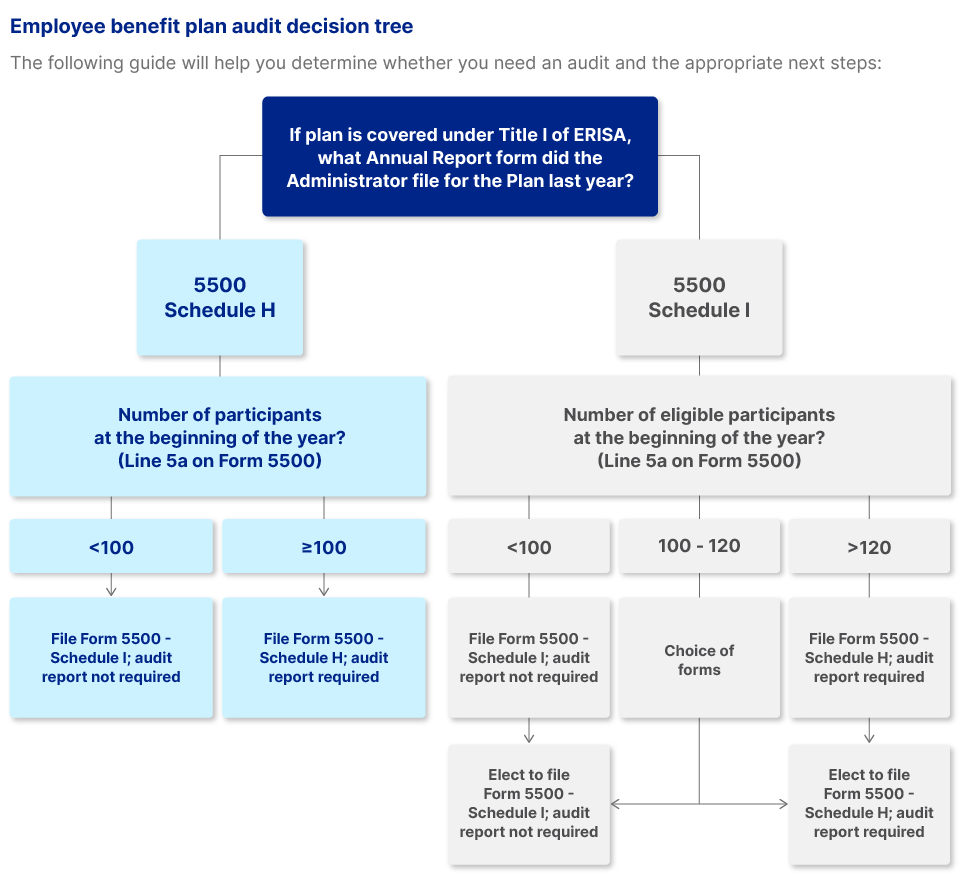

Are you required to have an audit of your employee benefit plan?

Employee Benefit Plan Advisory

Beyond the audit, our team advises plan sponsors in many areas, including:

- Building a strong team of service providers

- Strengthening internal controls, improving efficiencies and helping to ensure adherence to plan provisions and ERISA guidelines

- Preparing for an audit and DOL or IRS examinations

- Advising corrections under DOL and IRS programs for prohibited transactions

- Valuation services for Employee Stock Ownership Plans