Committed to success

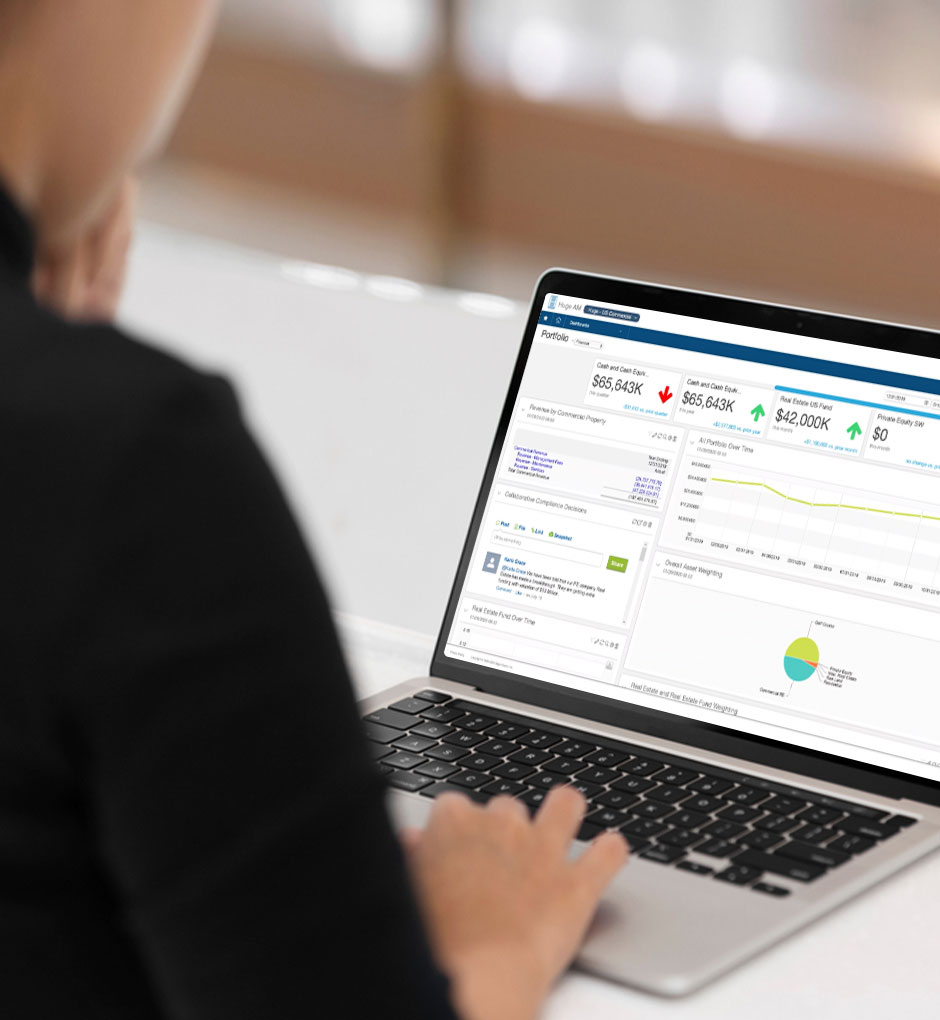

From diverse portfolios and investment planning to impact investing, legacy guidance and lifestyle goals, Sage Intacct financial management software helps you save money and resources, automate processes, strengthen internal controls, increase visibility, and easily report to stakeholders.