Liquidity Stage

Maximize value creation through comprehensive preparation and strategic execution of your defining transaction moment.

Preparing for your Defining Moment

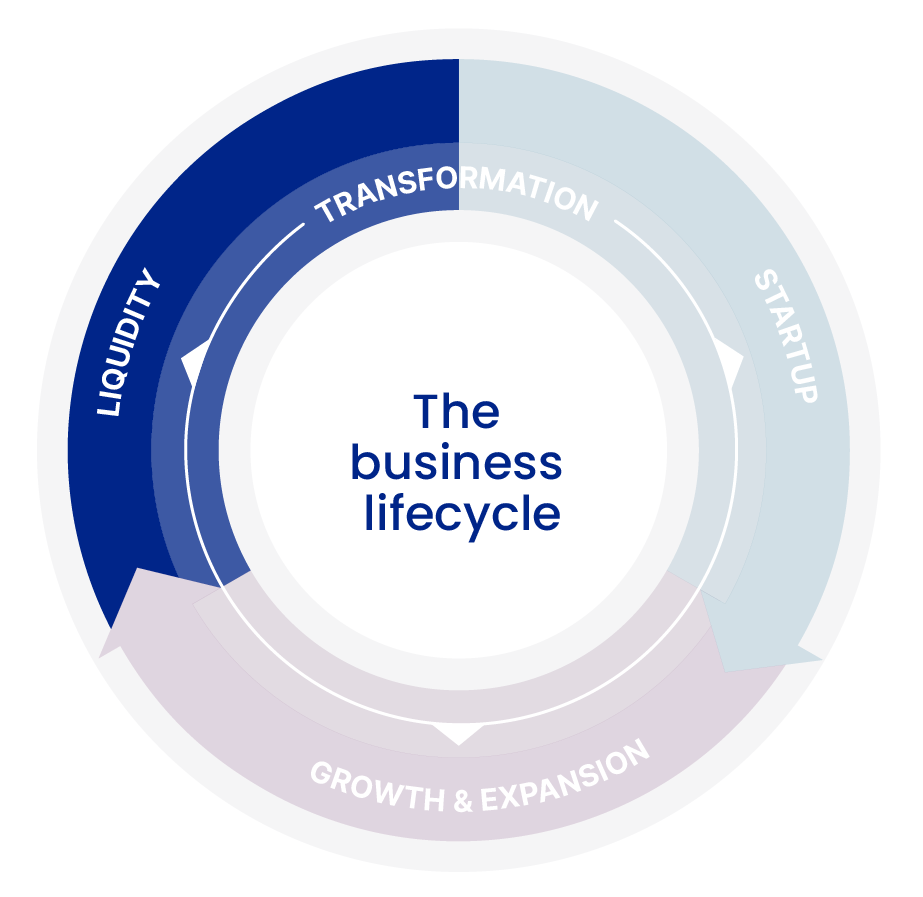

The liquidity phase represents a pivotal moment in your business journey—whether you’re pursuing an IPO, navigating a merger or acquisition, or transitioning ownership. This stage could be the culmination of everything you’ve built, or it could launch an entirely new chapter under different ownership or structure.

Success depends on having robust financial reporting systems, comprehensive compliance practices, defensible valuations, and the ability to tell a compelling financial story to potential buyers, investors, or public markets.

Key Liquidity Stage Challenges We Help Solve

At BPM, we understand that liquidity events are complex, high-stakes transactions where preparation and execution make the difference between maximizing value and leaving money on the table. Our team has guided numerous companies through successful liquidity events:

Achieving Transaction Readiness

Most businesses require 18 to 36 months of preparation before they’re truly ready for a liquidity event. Buyers, investors, and public markets will scrutinize every aspect of your financial operations, governance structures, and compliance practices.

Many companies discover too late that their financial systems, internal controls, or reporting processes are inadequate for sophisticated due diligence. Others find that historical accounting issues, tax compliance gaps, or operational inefficiencies significantly impact their valuation or transaction timeline.

Optimizing Valuation and Deal Structure

Understanding your company’s true value is essential for making informed decisions about timing, structure, and transaction partners. Many companies struggle to present their financial story in a way that maximizes valuation, including credible projections and compelling growth narratives.

Deal structure is equally important, as the wrong approach can significantly impact after-tax proceeds and future flexibility. Tax planning becomes particularly critical, as the difference between ordinary income and capital gains treatment can be substantial.

How BPM Helps

Managing Complex Due Diligence

Due diligence has become increasingly sophisticated, covering everything from financial performance to cybersecurity practices. Companies that haven’t maintained comprehensive documentation or formal processes often find themselves scrambling to provide required information.

Modern due diligence includes extensive technology assessments, cybersecurity evaluations, and operational reviews that go far beyond traditional financial analysis. Companies need to be prepared for this level of scrutiny across all aspects of their business.

Navigating Market Timing

Even well-prepared companies can find their liquidity plans disrupted by unfavorable market conditions. Successful companies maintain flexibility in their planning, developing multiple scenarios and alternative paths to liquidity when primary options are unavailable.

Potential Paths to Liquidity

Learn More About your Liquidity Options

Get detailed guidance on the most common liquidity strategies with our comprehensive resources designed to help you prepare and execute successfully.

How to Sell your Business

Selling a business is a complex process that requires careful planning and execution. With proper guidance, business owners can maximize value and navigate potential challenges that may arise during the transaction.

IPO Roadmap

IPO readiness requires strategic preparation across your company to meet public market standards. A structured approach helps transform operations, implement proper controls, and position leadership for success as a public company.

Why Companies Choose BPM for Liquidity Events

Companies preparing for liquidity events appreciate BPM’s comprehensive approach to transaction readiness and execution. We understand that every liquidity situation is unique, requiring tailored approaches that address specific industry dynamics and strategic objectives.

Next Steps for your Liquidity Journey

BPM has extensive experience helping companies successfully navigate liquidity events. If you’re considering your liquidity options or preparing for a potential transaction, our advisors can help you evaluate your readiness and develop a preparation strategy.

How BPM Helps your Business

Start the conversation

Looking for a team who understands where you’re headed and how to help you get there? Whether you’re building something new, managing growth or preserving success, let’s talk.