INSIGHT

AICPA expands disclosure requirements for stablecoin issuers in 2025

March 7, 2025

Industries: Blockchain & Digital Assets

Stablecoin Issuers Face Expanded AICPA Disclosure Requirements under latest release of the 2025 Criteria for Stablecoin Reporting Specific to Asset-Backed Fiat Pegged Tokens

Cryptocurrency companies issuing stablecoins (asset-backed fiat pegged tokens) need to brace for a significant increase in disclosure requirements.

As of March 6, 2025, the Assurance Services Executive Committee (ASEC) of the American Institute of Certified Public Accountants (AICPA) established new guidance for the “2025 Criteria for the Presentation and Disclosure of Redeemable Tokens Outstanding and the Availability of Assets for Redemption: Specific to Asset-Backed Fiat-Pegged Tokens.” Effective immediately, this proposal will require stablecoin issuers to provide much more detailed presentation and disclosure information in their reporting.

Why the Change?

Currently, there’s no standardized or consistent reporting format for stablecoin issuers. Because information about the redeemable tokens outstanding and redemption assets is not disclosed in the same manner, there is a lack of comparability, transparency and consistency of available information. This lack of uniformity makes it difficult for investors to compare different stablecoins and assess their underlying stability. The AICPA’s guidance addresses this problem by establishing clear criteria for disclosures in three key areas:

- Outstanding Redeemable Tokens: This includes details about the total number of stablecoins currently in circulation and any relevant disclosures.

- Redemption Assets: The types and amounts of assets backing the stablecoin’s value will need to be clearly specified.

- Sufficiency of Assets: Disclosures will ensure the value of the backing assets is sufficient to cover all outstanding stablecoins.

While some regulators such as New York Department of Financial Services (NYDFS) have provided guidance related to stablecoin unit backing, redeemability, reserve reporting and certification, the AICPA guidance goes one step further in the level of detail required for disclosure and presentation.

Take Action Now

In order to comply with the new guidance by fiscal year end, significant preparation is needed. Here’s what you can do:

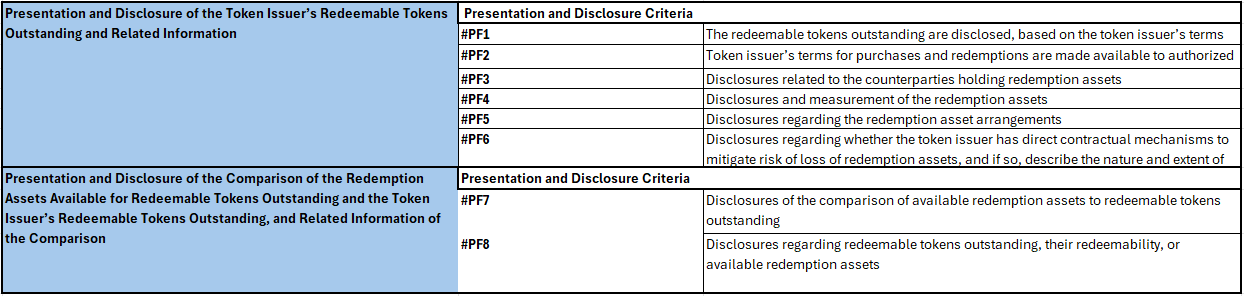

Conduct a Compliance Assessment: Develop a detailed understanding of the disclosure criteria along with the related points of focus to assess the compliance requirements against the current disclosure and reporting capabilities. Below table summarizes the presentation and disclosure criteria at the macro level.

Stablecoin Reporting Criteria | Resources | AICPA & CIMA

For each criterion however, additional detailed scoping and “point of focus” guidance needs to be applied. For example, in arriving at the redeemable token outstanding disclosure (#PF1 criteria), token issuers will need to be able to define the natively minted token quantity for all tokens in scope which includes:

1) Defining which minted tokens are in scope and based on issuer’s terms, disclose which distributed or blockchain networks and smart contracts are in scope.

2) Disclose the amount of redeemable tokens outstanding by starting with the total natively minted token quantity and subtracting any burned and nonredeemable tokens.

3) Identify the nonredeemable tokens that fall into “temporarily” vs “permanently” nonredeemable category.

4) Disclose known unresolved events or occurrences that have affected the mechanics, security, maturity and maintenance of the distributed ledger or blockchain networks when they have materially affected the number or redeemability of tokens.

- Develop Risk Assessment: Based on the compliance assessment and gap analysis, the impact and prioritization of the new disclosure standards should be evaluated based on the company’s risk profile.

- Develop a Roadmap for Compliance: Based on the compliance and risk assessment, prioritize and plan the changes needed in policies, controls, and processes to comply.

BPM’s Blockchain and Digital Assets Team can help navigate the upcoming AICPA stablecoin disclosure rules. Contact us today to set up a free consultation in how we can assist in assessing your compliance risk and developing your roadmap for success.

Daniel Figueredo

Partner, Advisory and Assurance

Nonprofit Co-leader

FinTech Leader

Daniel is an Advisory and Assurance Partner at BPM, and a leader in BPM’s Nonprofit, Blockchain and Digital Assets and …

Javier Salinas

Partner, Tax - International

Blockchain and Digital Assets Leader

Javier is a distinguished international tax advisor with over 21 years experience. Clients rely on Javier when navigating complex cross-border …

Start the conversation

Looking for a team who understands where you’re headed and how to help you get there? Whether you’re building something new, managing growth or preserving success, let’s talk.