INSIGHT

Consolidated Appropriations Act and Employment Incentives

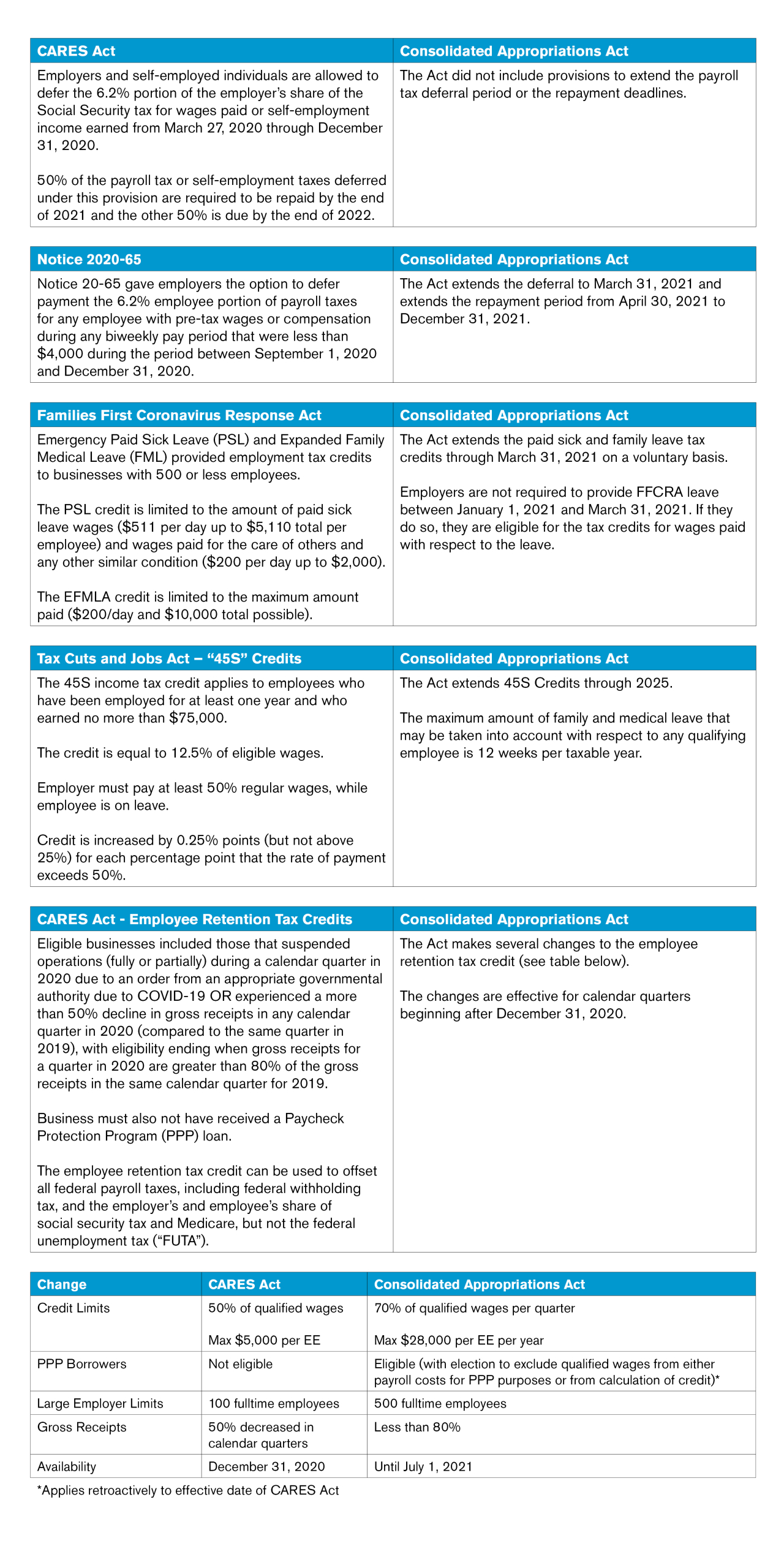

When the Coronavirus Aid, Relief, and Economic Security (CARES) Act passed on March, 27, 2020, it included an employee retention credit that motivated businesses to retain employees through the first major wave of shelter-in-place orders in the U.S.

But the newly passed Consolidated Appropriations Act includes significant modifications to the employee retention credit for 2021. Here are the key considerations small businesses should keep in mind for the year ahead.

For more information about the changes within the Consolidated Appropriations Act may affect your business, please reach out to BPM Partner Andre Shevchuck.

Start the conversation

Looking for a team who understands where you’re headed and how to help you get there? Whether you’re building something new, managing growth or preserving success, let’s talk.